learn why glidepaths are different

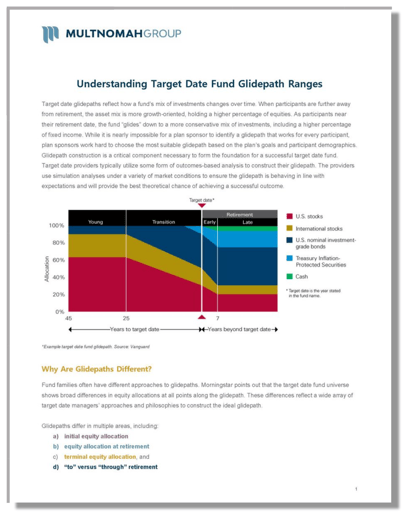

Target date glidepaths reflect how a fund’s mix of investments change over time. When participants are further away from retirement, the asset mix is more growth-oriented, holding a higher percentage of equities. As participants near their retirement date, the fund “glides” down to a more conservative mix of investments, including a higher percentage of fixed income. While it is nearly impossible for a plan sponsor to identify a glidepath that works for every participant, plan sponsors work hard to choose the most suitable glidepath based on the plan’s goals and participant demographics.

Glidepath construction is a critical component necessary to form the foundation for a successful target date fund. Target date providers typically utilize some form of outcomes-based analysis to construct their glidepath. The providers use simulation analyses under a variety of market conditions to ensure the glidepath is behaving in line with expectations and will provide the best theoretical chance of achieving a successful outcome.

For an in-depth understanding of target date fund glidepath ranges, download our full guide by filling out the form to the right.

For a complete toolkit of materials focused on target date funds, click here.

For instant access to our guide, please fill out the form below.

© 2025 Copyright Multnomah Group Inc.